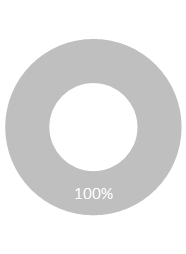

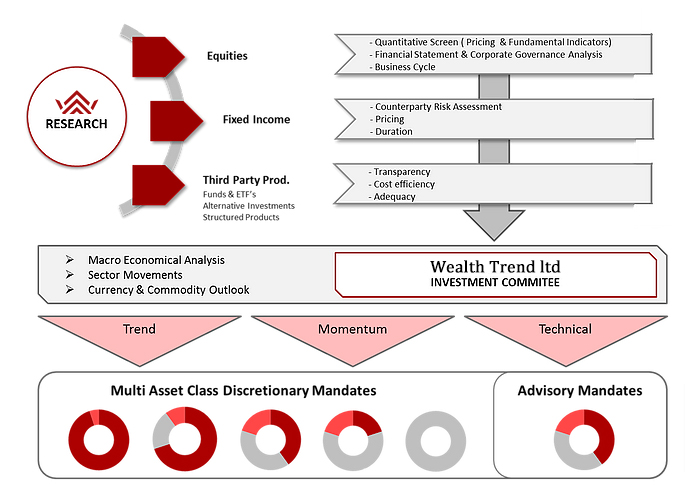

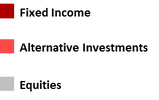

The global diversified FIXED INCOME portfolio mainly consists of fixed income instruments and aims to provide risk averse investor with a stable return.

Expect. Return: 3% p.a

The YIELD strategy might be of interest for investors who want to participate in a conservatively managed portfolio and while profit from capital gains of carefully chosen investment opportunities in equity markets.

xpect. Return: 3 - 5% p.a

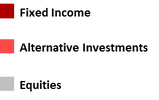

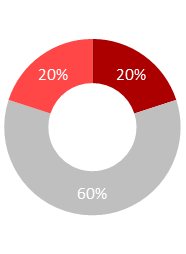

The BALANCED strategy seeks to create a moderate return by balancing risk and return with an actively managed and equal weight of exposure in fixed income and equities. The portfolio can be completed with some alternative investments.

Expect. Return: 6 - 8% p.a

The GROWTH mandate seeks to produce advanced returns by investing primarily in equities but also in carefully chosen alternative investment and FI opportunities. This strategy is designed for investors with a higher average risk tolerance.

Expect. Return: 8 - 10% p.a

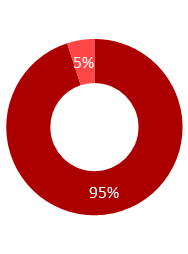

The pure EQUITY mandate is an aggressive strategy for investors with a long-term investment horizon and a HIGH RISK tolerance. The aim of this portfolio is to create a constant capital growth by investing in international stock market listed equities.

Expect. Return: +10% p.a